Ecommerce Marketing Study

Ecommerce Marketing Study

We recently surveyed 1,000 consumers about their holiday shopping habits to find out how they expect to shop this season. The results may surprise you.

Key Ecommerce Marketing Study Findings:

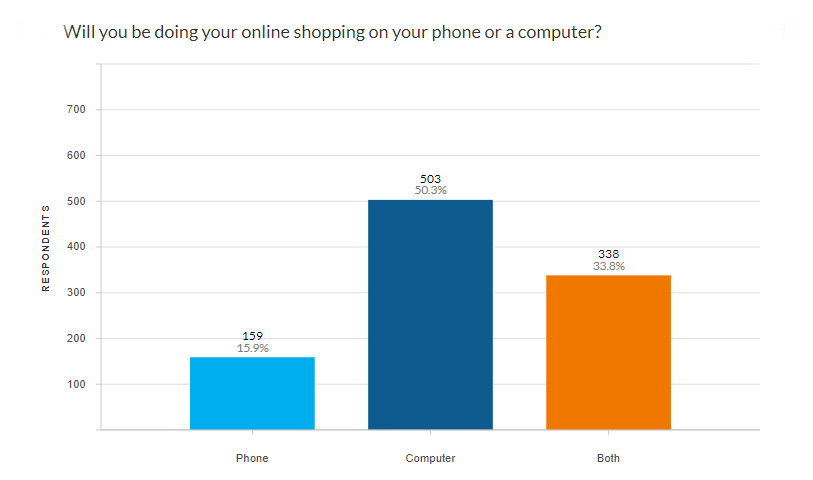

- Most consumers will be shopping and buying on a desktop (50%), followed by both (33%) and a mobile phone (15%) being the lowest. This shows a big change with more people having access to computers are home and making major purchases on an actual desktop computer.

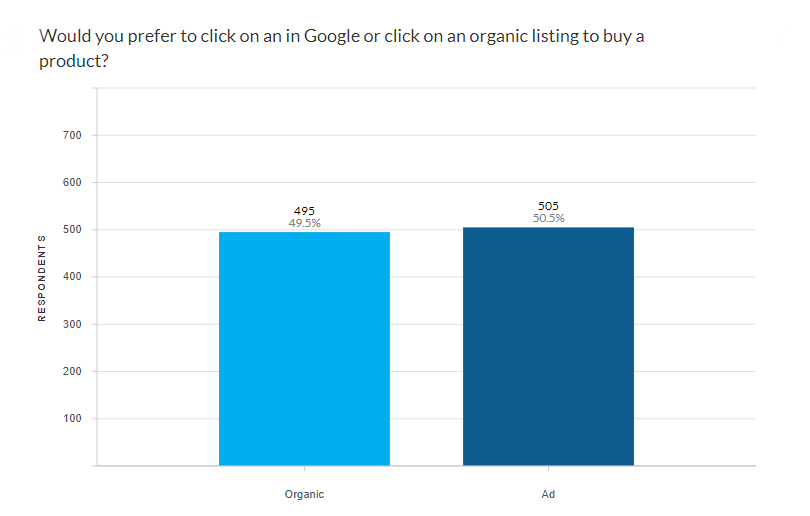

- Consumers were equally open to clicking on an ad in Google or an organic listing in Google for purchasing a product. This is significant, as studies in the past have shown strong favoritism for organic listings.

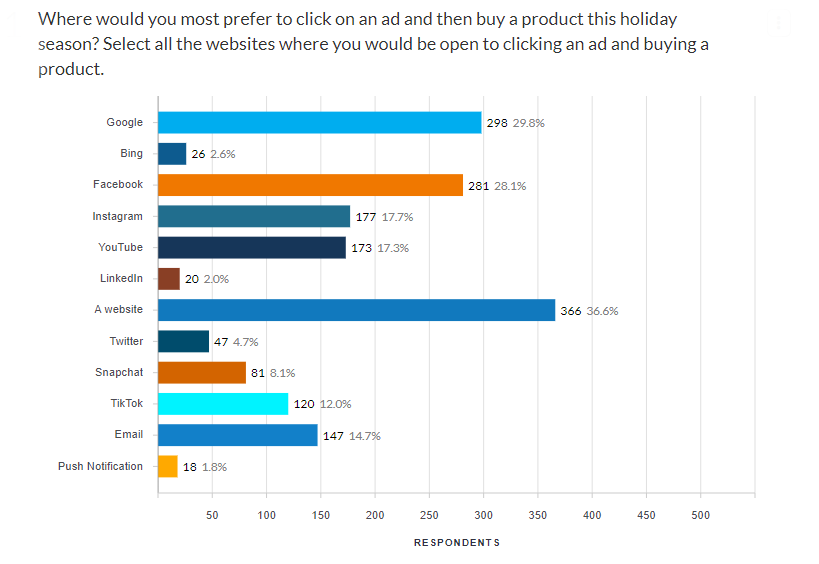

- When excluding Amazon, consumers listed websites as the number #1 place they would like to buy, following by Google, Facebook and Instagram. LinkedIn, Bing, Twitter and Push notifications were the places they wanted to purchase a product from the least.

- Consumers are shopping and purchasing products much earlier this year.

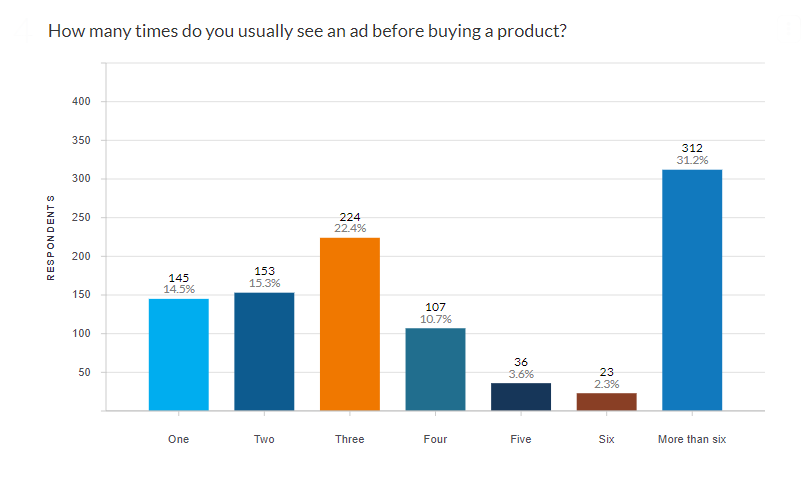

- Only 14% of consumers will buy a product the first time they see an ad. Out of people who purchase, 31% will actually need to see an ad 6 times or more.

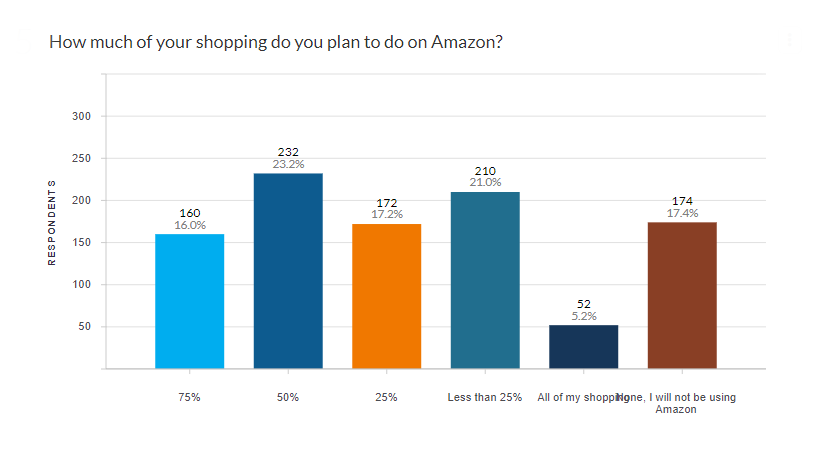

- A total of 60% of people will be doing less than 25% of their shopping on Amazon. In turn, 40% will be buying more than 25% of their gifts here. This shows there is still a very large market that needs to be reached outside of the marketplace giant.

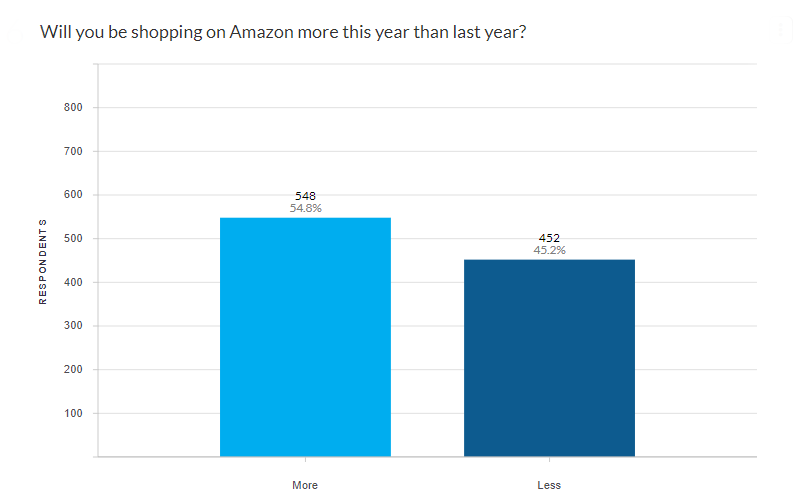

- Compared to last year, 54% of people will be shopping more on Amazon this year.

- Free shipping and fast site speed are essentials for retailers during the holiday season.

- Despite the current economic climate, more than half of consumers plan to spend the same or more this year.

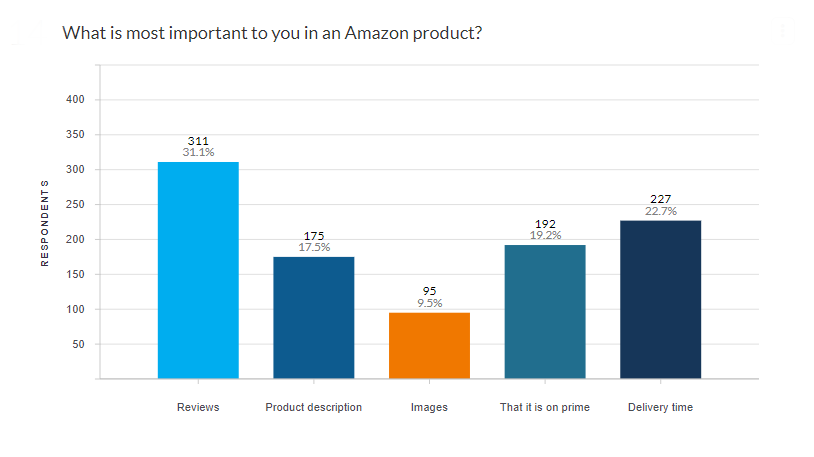

- The most important deciding factors in an Amazon purchase are the number of stars and positive reviews, followed by delivery time.

Ecommerce marketing study Shows Consumers are most open to buying products from ads on websites

Today’s display ads can be ultra-targeted – by demographics, sales funnel stage, interests and hobbies and more. That helps explain why they’re one of the most effective advertising channels, as proven by the response to our first survey question.

Nearly 37% of respondents chose websites as their preferred advertising platform. Google and Facebook ads are a close second, at 30% and 28%, respectively. It’s likely all these channels are popular because they target users so accurately.

Googles ads and organic ads work equally well for ecommerce marketing

Although consumers are aware when ads are paid for, and may naturally trust those ads less, the fact remains that a well-targeted Google paid listing is just as effective as an organic result.

With 49.5% of consumers choosing organic and 50.5% choosing paid ads, there’s hardly a statistically significant answer here. What’s the takeaway? A well-rounded strategy that incorporates both paid ads and SEO strategy is essential to capturing the most conversions over the holidays.

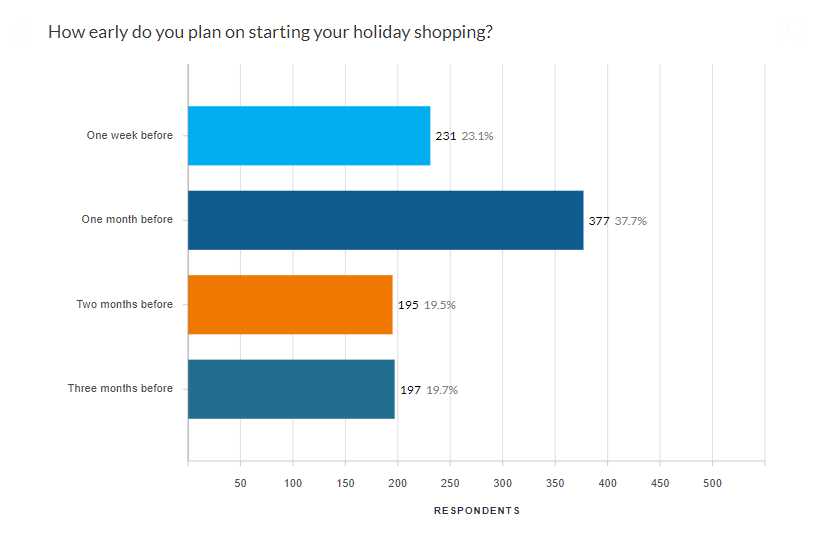

Ecommerce marketing study shows most consumers start shopping one month before the holiday

It’s almost the most wonderful time of the year … although consumers won’t be out shopping in force quite yet. Nearly 38% say they don’t start holiday shopping until one month before.

Ecommerce Marketing Study

More surprisingly, 40% of consumers start shopping two or even three months before the holiday. To capture all of these essential holiday sales, retailers will need to have website improvements “wrapped up” and an advertising strategy in place sooner rather than later.

Ecommerce marketing study shows serve ads many times for effective ecommerce marketing

This graph shows how difficult it can be to find the ideal number of times to show an ad. Just over 50% of consumers only need to see an ad between one and three times before clicking buy. Yet more than 30% usually see an ad more than six times before they’re convinced.

Don’t get discouraged – get testing! Audience testing will show you who’s clicking when, helping you improve your accuracy and get more clicks from holiday shoppers.

Consumers are split on how much they’ll use Amazon

As ecommerce explodes, Amazon stock has been reaching record highs and North American sales increased 43.4% in the second quarter. It should come as no surprise that about 45% of consumers plan on doing 50% or more of their shopping on this marketplace behemoth.

Ecommerce Marketing Study

What’s more interesting is that 17% don’t plan to use Amazon at all, and 38% will use it for a quarter of their shopping or less. That’s a big piece of the pie that will be left for retailers who don’t sell on Amazon. The best strategy? Do both.

Ecommerce marketing study shows nearly 55% of shoppers plan to use Amazon more than last year

While consumers are split on how many of their purchases they’ll make on Amazon, they know one thing for certain: It will be more than last year. Almost 55% of survey respondents plan to increase their use of Amazon this year.

However, that leaves 45% who say they’ll actually be using Amazon less. This is in line with recent trends such as a rise in consumers wanting to support small businesses and looking for direct-to-consumer experiences. Again, a well-rounded strategy will be key this holiday season.

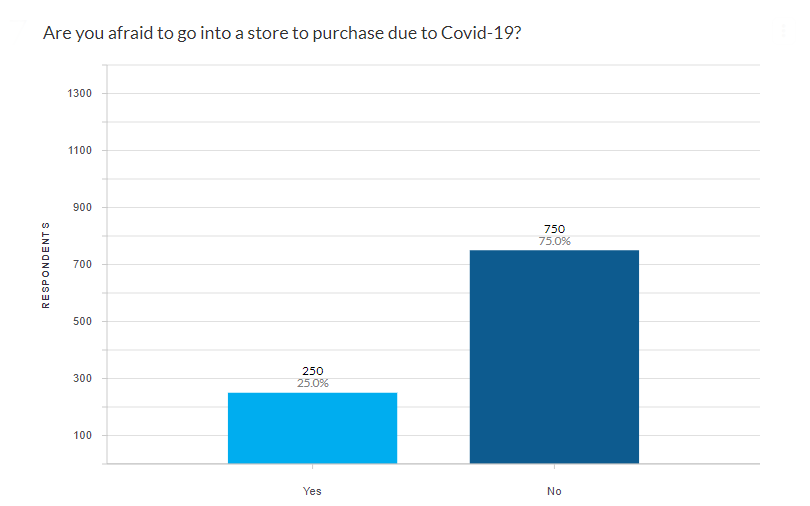

Three-quarters of shoppers say they’re not afraid to go into stores

It may be government regulations, rather than consumer fear, that’s keeping people out of stores. About three-quarters of survey respondents said they’re not afraid to go into stores.

Although consumers are confident, Black Friday crowds are probably out this year. Target and Walmart have already announced they’ll be closed on Thanksgiving, and many retailers are planning on starting sales earlier and spreading them out to reduce crowding. Curbside pickup will also be essential: Macy’s is implementing this service for the first time ever this year.

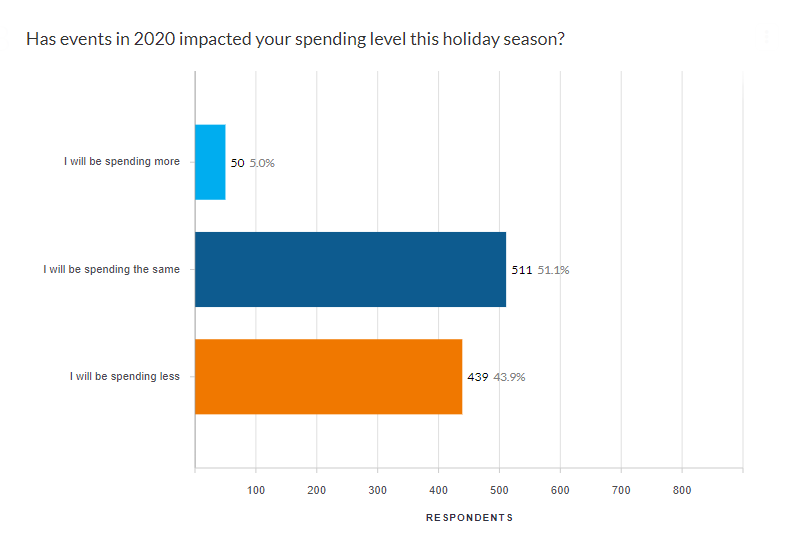

Ecommerce marketing study shows 56% will spend the same or more this holiday season

Despite high unemployment and an uncertain economic future, more than half of consumers are still planning on spending the same amount on holiday shopping this year. Five percent are even planning on spending more!

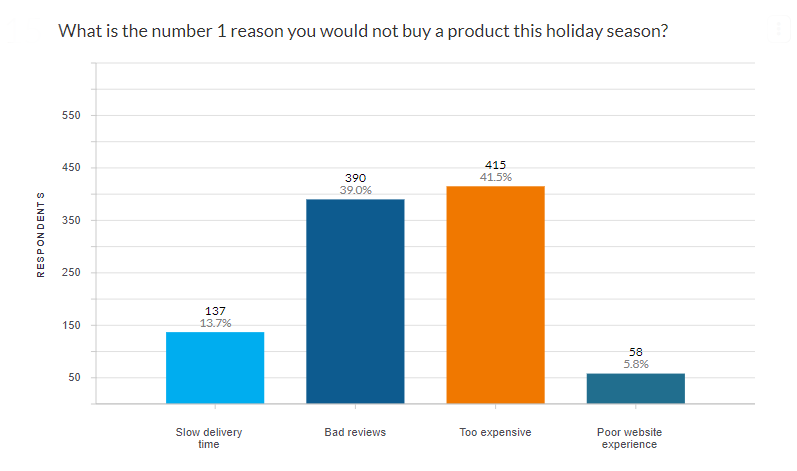

Still, that leaves 44% who are planning to spend less this year. That’s a sizeable chunk of consumers who will likely be hunting for deals, comparing prices and reading reviews before they hit the “buy” button.

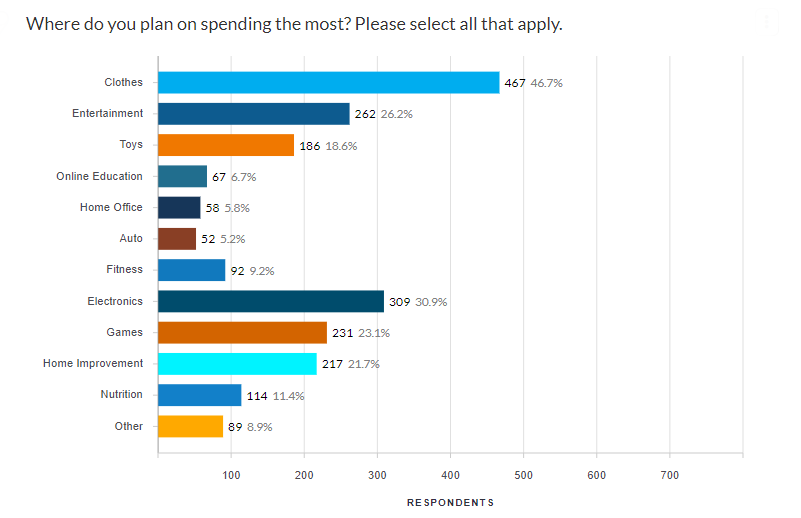

Shoppers will spend the most on clothes and electronics

In general, consumer spending has shifted from “wants” to “needs”: spending on nonessentials has fallen, but spending on groceries, cleaning products and other essentials is skyrocketing. The holidays are the exception to the rule: Splurging is a time-honored holiday tradition, and this year, it’s all about clothes and electronics.

Forty-seven percent of respondents plan to spend the most on clothes, while 31% will be putting electronics under the tree. Competition in these industries will be high, and a solid holiday strategy will be needed more than ever.

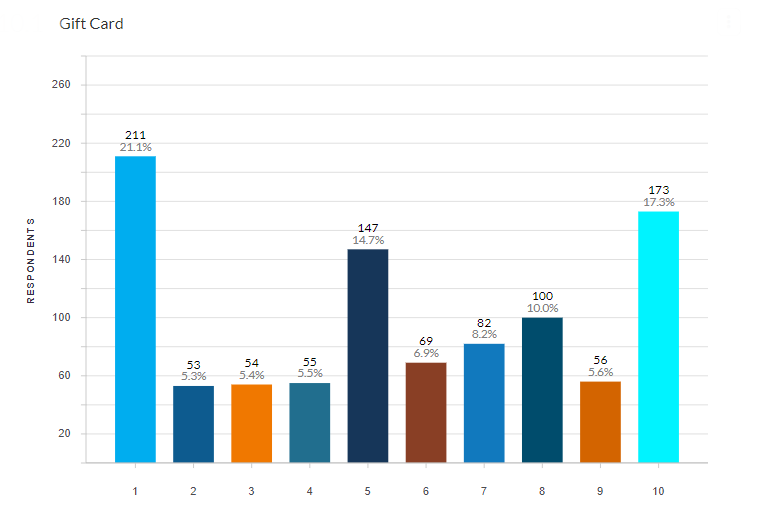

Gift cards are the most important factor for only 17% of consumers in ecommerce marketing

Next, we asked consumers to rank nine features of online shopping, from gift cards to free shipping, in order of their importance this holiday season. Many of the results were definitive: Gift cards, for example, are not a deciding factor for most consumers.

Only 17% ranked gift cards as the most important, while 21% ranked them dead last. Nearly 15%, however, weren’t so sure, and gave them a moderate ranking of five.

Coupon codes are slightly more important than gift cards

Coupon codes saw a similar split, with 22% ranking them most important and 19.5% ranking them in last place. Consumers are able to look up coupon codes online, which could account for their slight edge over gift cards.

Many consumers ranked coupon codes somewhere between 5 and 9, showing that they do have moderate importance. But there are other factors that will really turn the tables for retailers.

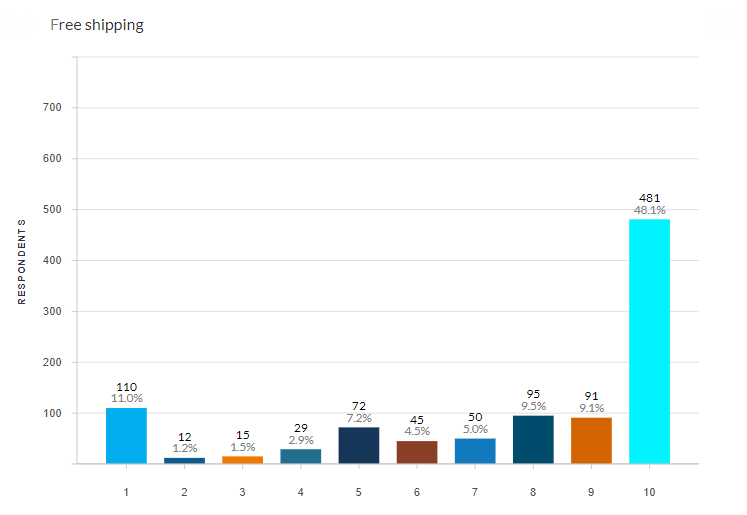

Nearly 50% of shoppers ranked free shipping as the most influential factor in ecommerce marketing strategy

Fact: Consumers love free shipping. One study from the National Retail Federation found that 75% of consumers surveyed expect delivery to be free even on orders under $50, and 65% look up the threshold before they add items to their cart.

Free shipping was a runaway winner in our survey as well, with 48% of consumers listing it as the most important feature when they’re shopping online. The lesson is clear: Offer free shipping, at least for purchases over a certain amount, or lose sales.

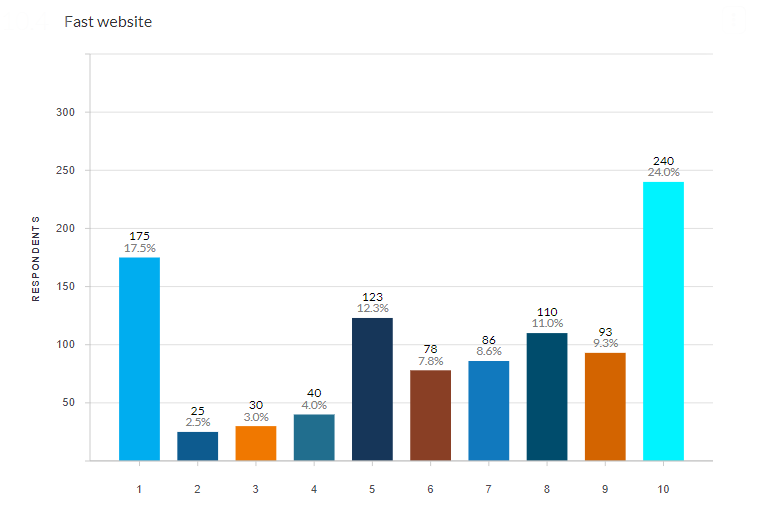

A fast website is essential to almost three-quarters of shoppers in ecommerce

Attention spans seem to get shorter and shorter each year. Consumers expect instant satisfaction, and they’re not going to wait for your product pages to load. In fact, even a 100-millisecond improvement in site speed can increase conversion and average order value for retailers.

In our survey, almost one-quarter of consumers listed site speed as their most important factor. Plus, various metrics such as first input delay and largest contentful paint affect your Google search rankings. Retailers need a fast website to satisfy consumers and to improve their organic visibility.

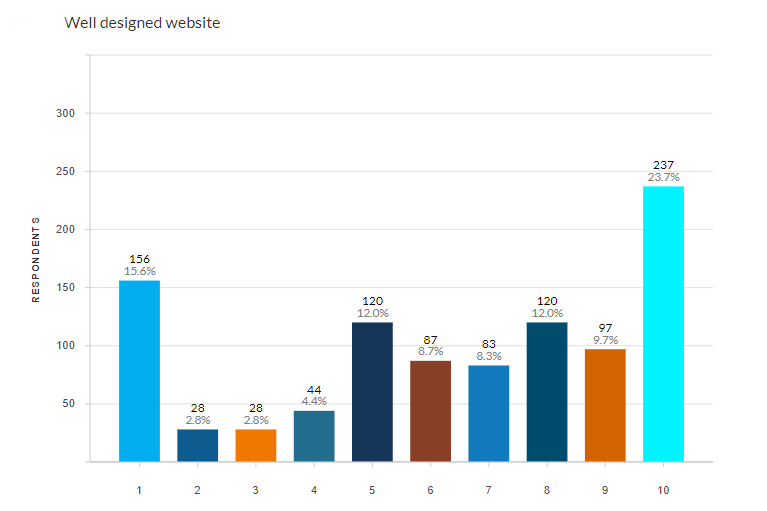

A well-designed website is also important to online shoppers

Speed is great, but if consumers can’t intuitively navigate your site, they’ll still bounce without buying. This year, every major retailer is improving their ecommerce experience in order to get a slice of those short attention spans. That means one thing: Competition is about to increase.

A well-designed website received nearly the same rankings as a fast website, which shows retailers that both are equally important. Use a conversion optimization tool to A/B test various website pages, create heatmaps and customer journeys and determine the best way to get customers from Point A to Point Buy.

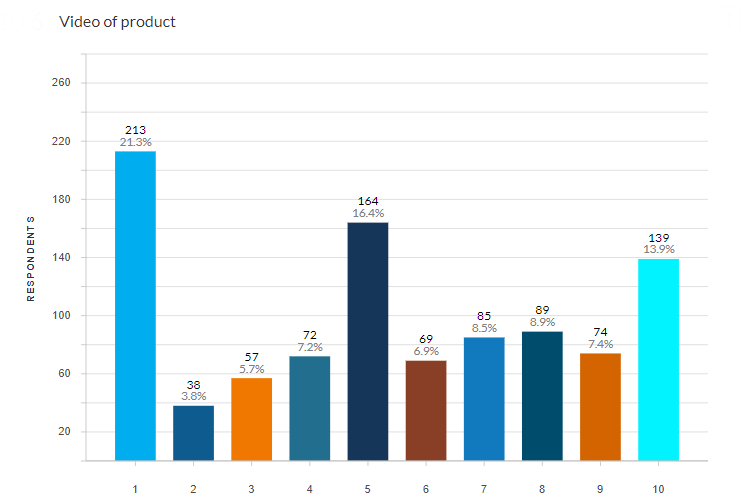

Videos of the product may not be as influential as you think in an ecommerce marketing strategy

There’s no doubt that video marketing is a great way to build your brand, create trust with an audience and move buyers down the sales funnel. But once they’ve reached the evaluation and purchase stages, product videos may not be as important as you think.

About 55% of consumers ranked video as a 5 or less in importance, including just over one-fifth who thought product videos weren’t important at all. Only 14% of respondents ranked video as the most influential factor in their online holiday shopping.

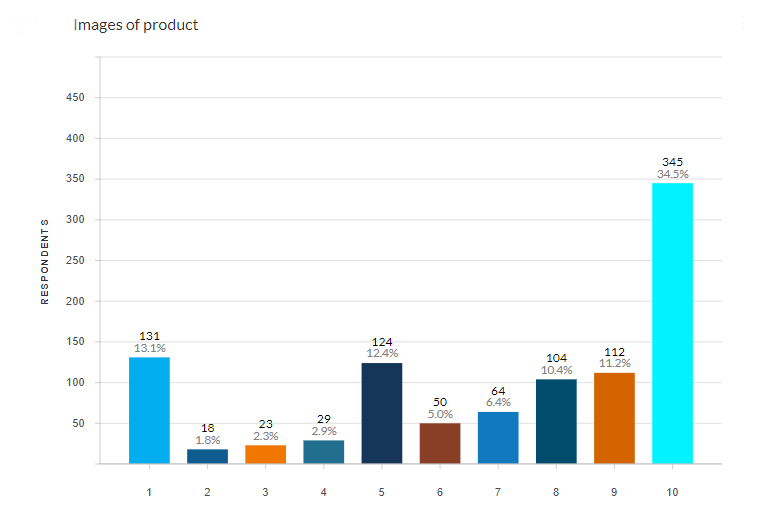

Images remain a fundamental part of online shopping

Consumers may not be clamoring for videos of a product, but images are a must-have. Almost 80% ranked product images as a 5 or higher in importance, and 35% gave images the number-one spot.

Before the holidays hit, check that your product images are up to date, high quality and prominently displayed on the page. Consumers will be looking for them.

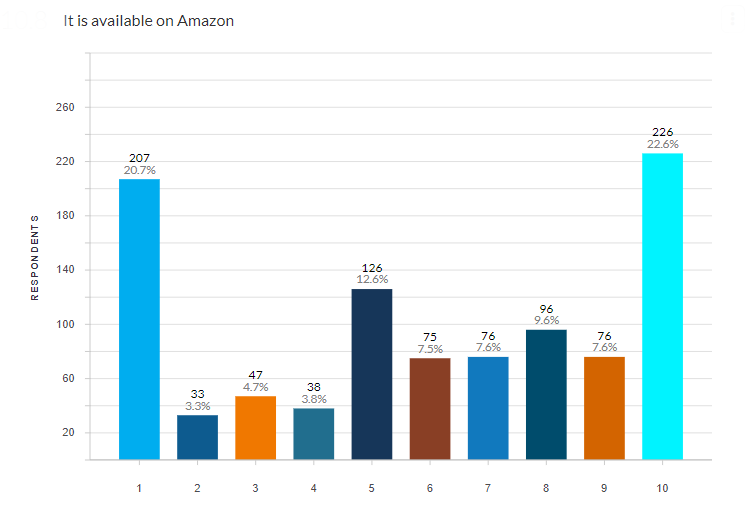

Ecommerce marketing study shows shoppers are split on the importance of Amazon

Amazon is a polarizing topic this year, and the trend continues in consumers’ ranking of its importance to their online shopping plans. While 23% ranked it the most influential factor, 21% ranked it the least influential.

The majority of consumers fell somewhere between a 5 and a 10 on Amazon’s importance. This again emphasizes how essential a well-rounded strategy will be this year: While you shouldn’t put all your eggs in the Amazon basket, don’t write it off, either.

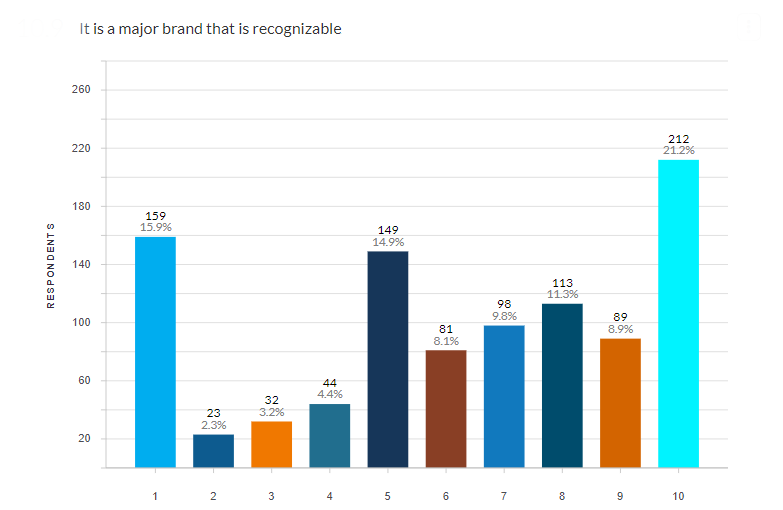

Major brands could have a slight edge in ecommerce marketing

When finances are tight, consumers turn to brands they know they can trust to deliver quality products that make them feel good about their purchase. That’s why almost 75% of consumers rated the influence of a recognizable brand at 5 or above.

Smaller brands shouldn’t give up, though. Features like free shipping and product images are more important this holiday season than having a recognizable brand name.

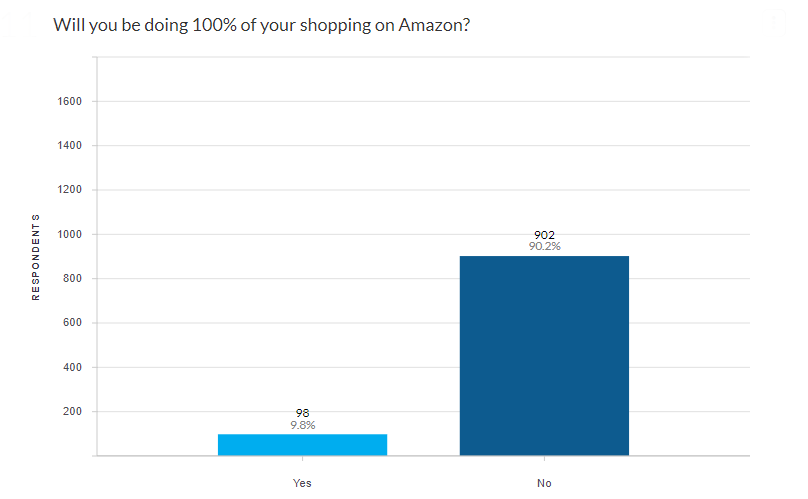

Only 10% of consumers say they’ll do all their shopping on Amazon

Amazon’s popularity is undeniable, but it isn’t the only place people will shop. Just 10% of respondents say they’ll shop solely on Amazon.

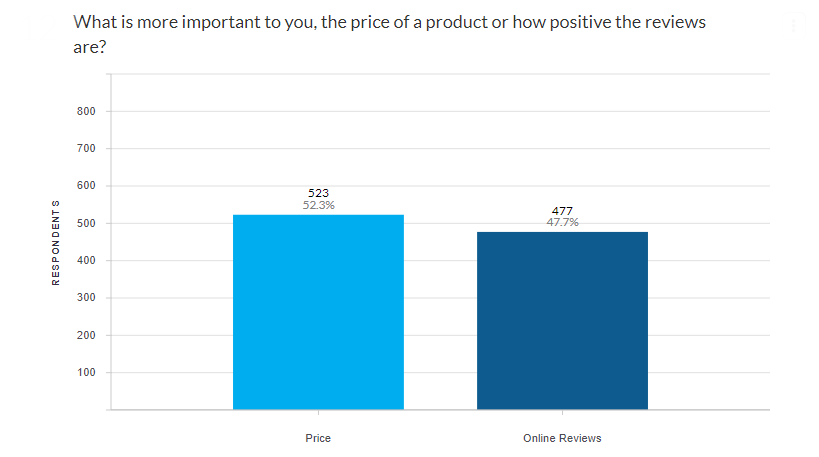

Price and good reviews are equally important

Most retailers know that positive reviews can influence customer behavior. A famous Harvard Business Review study found that a one-star increase in a Yelp rating can lead to a 5 to 9% increase in revenue. But this year, consumers may be a little more price-conscious, as well.

In our study, consumers were almost equally split the importance of price and reviews. The truth is that both of these things matter. Can’t lower your prices? Offer free shipping, and learn to ask customers for reviews in the right way. The higher priced your product, the more important reviews will be.

Desktop still rules when it comes to ecommerce marketing strategy

Reviews and delivery time are most influential on Amazon

On Amazon, many consumers are buying from unfamiliar brands and looking for bargain prices, making reviews even more important. Thirty-one percent of consumers list reviews as the most influential factor, underscoring the important of handling negative reviews quickly and professionally.

Delivery time comes in second place, with nearly 23% of consumers saying it’s the most important. Amazon’s two-day, one-day, and even same-day delivery options are a big draw for its Prime memberships. Reliable fast delivery could explain why Amazon Prime spending and memberships are surging due to the pandemic.

Ecommerce Marketing Strategy Conclusion

The 2020 holiday shopping season will be unlike anything we’ve seen before. Ecommerce sales are booming, and Cyber Monday is expected to be record-breaking. At the same time, financial uncertainty and unemployment are higher than ever before.

However, consumers will still be shopping. And they will still be looking for many of the same things: Free shipping. Good reviews. Quality images. A fast and easy-to-use website.

A successful strategy to capture conversions this holiday season will recognize that these digital marketing standbys are now even more essential. There’s a potential $12.7 billion on the table on Cyber Monday alone. To the prepared retailer go the spoils.