As founder and CEO of Option Alpha — an industry leader in options trading — Kirk Du Plessis sure knows a thing or two about a special kind of investing. At the same time, the success of his business proved he knows how to disrupt a market with vigor. Fortunately for us at Ignite Visibility University, Kirk takes us into the nitty gritty of both.

Who is Kirk Du Plessis?

I’ve known Kirk for a couple of years now, mostly for his expert capabilities in the marketing space. He knows options trading like the back of his hand. Today, he’s incredibly well known in the trading space.

Kirk says he always knew he wanted to work in finance. He says that there was “a lot of volatility financially” with his parents as a child, a reality that inspired him to break the cycle.

“They seemed to always have money or not have money. It wasn’t always because of the decisions they made. It was the industry they were both in, which was the mortgage industry. It was either really good or really bad.”

Life took Kirk to University of Virginia, then to New York. This was where he worked in investment banking — and while he liked the industry, he did not like the hours and time spent working. Next up was experience in real estate investment trust and public markets. While he enjoyed this as well, he couldn’t seem to find his niche.

For Kirk, the transition to options trading was a gradual one. He had dabbled in options in school and in New York and eventually decided it was for him. That was more than a decade ago.

Ultimately, Kirk launched Option Alpha in 2008, yet another addendum to an already storied career in the finance industry. It has only gone up since then.

What is Option Alpha?

Option Alpha started as just a blog, but eventually grew into courses, training material, podcasts and software.

Now, the company is at the beginning stages of launching a new auto trading platform with multiple major industry brokers.

“It’s been quite the journey so far, but it has always been a focus and a dream of mind to continue the fintech path.”

Kirt has a huge following on social media, including YouTube (where he has 191,000 subscribers) and Twitter (where nearly 30,000 people follow for the goods). He offers a plethora of free resources, in addition to more nuanced strategy sessions and training programs.

What is Options Trading, & Why Is It Such an Enigma?

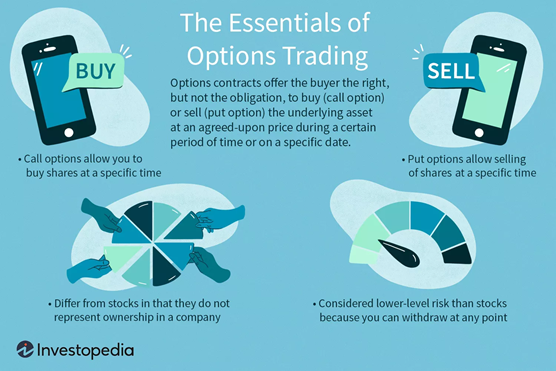

Image Source: Investopedia, The Essentials of Options Trading

At its core, options are contracts that give buyers the right (but not obligation) to buy or sell an asset at a predetermined price and date. Kirk says it’s “simply a transfer of risk.” They’re derivatives that sit atop an underlying asset (like Apple of Tesla stock).

Maybe you’re already doing options trading. You pay the insurance company a premium to trade risk. If an accident occurs, they take the bulk of the risk, but there are defined mechanics of the deal.

A lot of people have trouble getting comfortable with the concept of investing in general, especially options. Largely due to the complex nature of options, they aren’t typically a person’s first foray into the investment world. There’s also limited education in the space, making it a hurdle for folks to get started on their own.

“When people start investing, it’s pretty simple to understand that if you buy a stock and it goes up, then you sell it and make money. You now start to add in this multidimensional aspect of options, which is time decay, volatility and all that stuff. It becomes a different aspect altogether.”

Kirk adds, “There are more ways to skin a cat than just buying something low and selling it.”

What It Means to Disrupt an Industry, According to Kirk Du Plessis

One of the things that drew Kirk to options so intently is their ability to mitigate risk without sacrificing profit.

“The problem as I see it with stocks is that you carry the full downside risk of the position every single time. What you can do with an option contract is transfer some of that downside risk to somebody else.”

With the growing success of Option Alpha over the last 12 years (thanks to unsurpassed educational content), it’s clear that Kirk took this skill of options trading and applied similar theories to his business.

Option Alpha’s most recent and notable move has been the development of their options trading technology, the likes of which have never been done before. It’s been five years and millions of dollars in the making.

“If you think about every major disruptive technology that has been released — and I think this is disruptive technology — it didn’t change the need to do something. It just changed the process by which we do it.”

Kirk talks about examples like Netflix. Before Netflix, people had the need for entertainment, specifically to watch movies and TV shows in a nonlinear time frame. That’s why Blockbuster was so successful during its heyday. Netflix didn’t change our need to watch movies. It just changed how we watch them — immediately on our TV, instead of going to the store and getting the tapes.

With options technology, Kirk and his team at Option Alpha are trying to give people the ability to pre-program all of their trading using templates and drag-and-drop simple decision frameworks (no coding required).

In short, it’s options made easy for the everyperson. It’s not meant to change the concept of options, but rather alter (and improve) how people go about options trading.

So why change the path there at all?

According to Kirk, “I think people are going to free up their time to actually focus on things they should be focused on. Things like strategy.” He wants folks to improve their process in life, starting with their investing habits.

“Why not just let automation and some technology do it for you?”

The upcoming Option Alpha technology is completely secure on the cloud. Everything connects to the investor’s broker, and the program runs on autopilot. At the end of the day, Kirk hopes investors will have more time on their hands to do whatever they want to do, investing or otherwise.

And that’s what it means to disrupt an industry, options style.

Options Tech Takes the Emotions Out of Our Decisions, and Community Fosters Growth

Join Kirk as he shows you exactly how to backtest, build, and clone entire strategies (stocks or options) inside our new autotrading platform. Plus, he's been hanging around for Q&A so you can get your questions answered directly from him. Save your seat https://t.co/JB6ygQENt7 pic.twitter.com/Uqq2I1DrPa

— Option Alpha (@OptionAlpha) October 5, 2020

As humans, we’re innately emotional. This can leave us paralyzed in decision-making, or guide us toward decisions that aren’t actually best for us.

Because of its automated nature, Kirk’s development helps remove the emotion associated with options trading for a more successful venture. At the same time, upwards of 250,000 people in the Option Alpha community make for a supportive place where you can do your best work (thanks to seamless template trading).

“Everyone talks about their strategy,” says Kirk, adding that you can’t possibly learn them all. But new tech lets traders create templates out of their unique strategy, which they can then share with countless others interested in learning. That template is secure, with no personal data attached to it, but it does let others see the structure of the strategy that you’re using.

“This has been completely missing in the industry. I can basically put all of my information on my particular strategy into a template, share it with you in one click, and now you have access. You can either run it on your account or close in and tweak a variable.”

Tesla Giveaway a Prime Example of Marketing with Serious Value In Mind

Kirk realized that disruptive marketing takes the cake. That’s why a Tesla giveaway or the equivalent amount of Tesla stock (depending on the winner’s preference) seemed so revolutionary to him and his team.

That’s right. They’re giving away a Tesla (or stock equivalent) to the person who refers the most people by their public launch date on February 1, 2021.

All they have to do is tell their friends to check out Option Alpha and sign up if they want to.

Kirk says he will personally drive the Tesla to the winner’s house if they want to and meet them with keys in hand.

For Option Alpha, Tesla is also a prime example of what it means to be a startup that disrupts an entire industry. While Kirk’s business is by no means small in terms of what it has to offer and how much it’s bringing in, his forthcoming automated technology is a route into big success.

Options Trading Industry, Get Ready for the Next Big Thing at Option Alpha

There was a time before the iPod, when CDs were the jam. There was a time before auto bill pay, when folks wrote checks. There was a time before every major industry disruptor — and as Kirk Du Plessis of Option Alpha knows, there will soon be options trading technology that will make today’s norm seem antiquated.