What is customer lifetime value (CLV)?

It’s what tells a company how much revenue they can expect from each customer over time.

It takes total customer revenue and expected lifetime into consideration, and is a critical metric in your marketing mix.

Watch a video on customer lifetime value and marketing or read more below.

What You’ll Learn:

- Why CLV is important

- How a business can calculate it

- How to boost CLV

- The most overlooked element of CLV

Most businesses have customer experience programs in place to inform them of how well they’re serving the consumers of their products.

One of the most important metrics for this program is the customer lifetime value (CLV) figure.

The CLV measures how much revenue a business can expect from one customer. The longer someone remains a customer, the higher their lifetime value.

But CLV is more than a math equation. As we’ll see in this post, CLV goes far deeper than just the value of a customer to the business.

Qualtrics defines CLV as the total amount of business that a customer provides to the company over their relationship. By understanding the total lifetime of a customer, CLV attempts to inform you of how well your messaging resonates with its audience and offers insight into what is going well and which areas it could stand to improve.

From a business perspective, this information is immensely valuable. Knowing where you can grow to meet the needs of your customers will help retain them in the long run.

Forbes notes that a business might spend up to 5x more on getting a new customer than keeping an existing one. This statistic is of extreme importance when it comes to calculating CLV.

The customer’s long-term benefit to a business is what CLV focuses on. Getting new customers is still a major part of marketing, but keeping those customers you already have is likely to have a far better return on investment.

Why is Customer Lifetime Value Important?

In today’s ever-changing world of competitive marketing, one of the constants is that it’s generally more profitable to build relationships rather than close a single sale.

It’s the reason you see so many companies investing in tactics such as content marketing and social media to boost their visibility and interact with their customers. Those pages help the overall customer experience, which, in turn, impacts the lifetime value of the customer to the business.

Customer lifetime is essential to your bottom line because of how expensive it is to get new customers per sale.

Remember that Forbes stat? New customers cost up to 5x more than existing ones. If you can get an existing customer to keep purchasing from you, you’re not spending more on customer acquisition cost. You invest, instead, on relationship-building, which is far cheaper than what it takes to bring in brand new customers.

Yet somehow, companies still fail to embrace the post-conversion, relationship-nurturing phase as wholeheartedly as the acquisition phase.

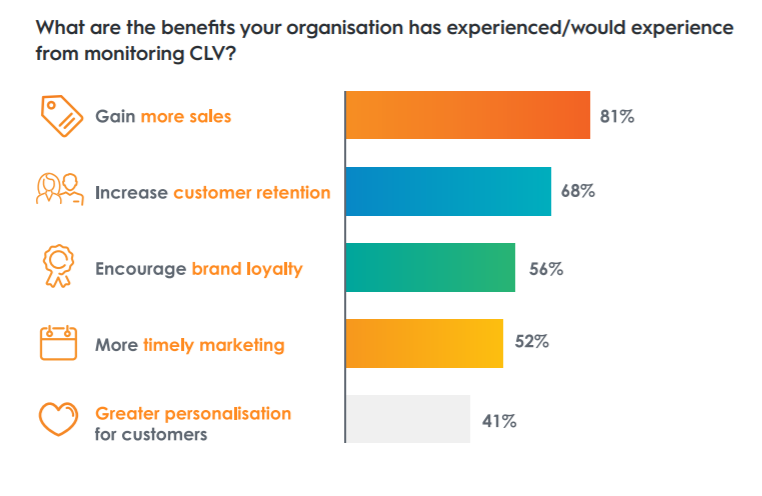

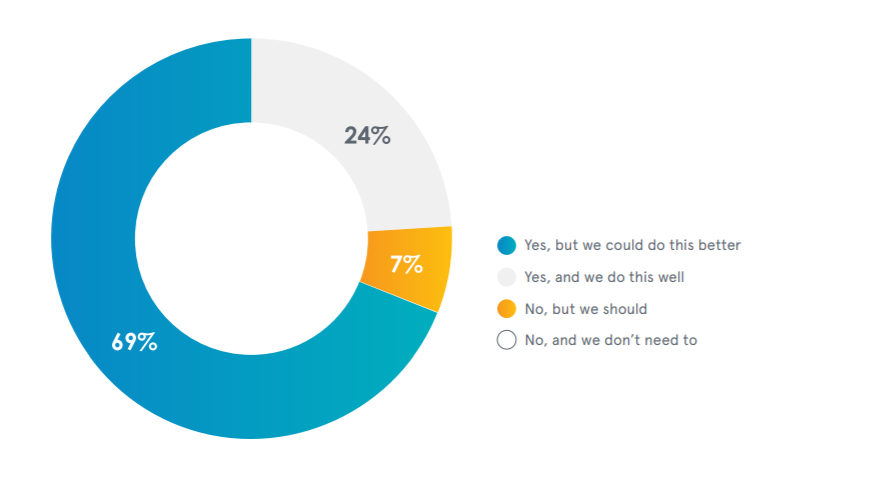

Companies to respond to whether or not they measure CLV, courtesy of Criteo

For example, if we had a fictional business selling 50 shirts at $10 profit per pair, then the net income from those shirts would come up to $500. If we spent $5 to convert a single customer that bought those seventy shirts, we would be looking at as much as $495 profit from that sale.

If, however, we had to convert 35 people at the cost of $5 per customer, then our overall profit drops drastically.

This example simplifies the idea of customer lifetime value and demonstrates why it’s such a significant metric to your business. Through a customer’s spending habits, you can determine what you’re doing right.

If you have a low CLV, it means something’s gone wrong in the buyer journey. A customer wasn’t satisfied with the product, your company’s follow-up, or something else along the way.

By understanding where your customer’s drop off in the sales or post-sales process, you can work to improve your process and retain more customers going forward. If you do that, you should see an increase in customer lifetime value.

Remember, the longer someone is a customer, the more they’ll spend, which means they’ll ultimately bring more value to your business.

Realistically, there are a few things that CLV can tell you about a business, such as:

- What type of clients are the most profitable: This group of customers should be the ones whose decisions carry the most weight, as the company makes the most money from their purchases.

- What products are best sellers: This particular metric can help you focus your resources on producing more of what “works.” It can point you in the direction of improving other products to mirror the success of that one.

- What type of products the highest CLV consumers enjoy: This can inform production values and help you attain better profit margins by producing more of an in-demand product, specifically focusing on consumers who spend the most on the company’s production.

- The amount of money the business can successfully pay to acquire another customer and still see a profit: This measure can help you determine its marketing goals for acquisition and retention, and adjust their budgets to suit.

CLV is about turning relationships into profit for the company. When properly leveraged, it can significantly increase your profit margins.

Additionally, proving CLV helps justify the acquisition cost per channel.

If, for example, you find that the customers you acquire through paid media are the most expensive, it doesn’t necessarily mean that it’s an inefficient channel.

If you run the equations and find that the CLV for customers acquired through paid media far exceeds the other channels in your marketing mix, then spending the most money there makes sense, as you’re making the most from it in return.

How Does a Business Calculate its CLV?

The math behind calculating CTLV is not complicated, but there are a lot of variables that a business needs to track.

Keep in mind, CLV isn’t a perfect measure.

The value is useful for informing business decisions, but it’s a ballpark figure at best. There are ways to customize the equation to get a more realistic picture; however, most businesses that go about calculating CLV do so through the application of a simple CLV or a traditional CLV equation.

Variables

When looking at a mathematical calculation, there will naturally be some variables that you need to address. For the CLV equation, these variables are:

- How much a customer spends during each of his or her visits (s)

- Number of times a customer visits the business per week (c)

- How much value each customer brings to the business per week (a)

Constants

As we’ve seen, certain things in this calculation vary.

However, there are a lot of numbers that the business assumes for the sake of simplicity. Within our calculation, these constants are:

- The average amount of profit the customer generates during his or her lifetime (m)

- The discount rate of current cash flows when compared to the future (i)

- How much profit each customer generates (p)

- Rate of retention of customers (r)

- How long the average customer interacts with the business (t)

The Calculations

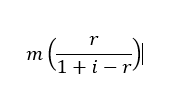

Now that you’ve sorted out the values you’re going to be using for our calculations, it’s time to apply them to the equations.

As mentioned above, you can use either a simple or traditional approach to calculate CLV.

The simple formula uses the average revenue earned per customer multiplied by the average customer lifespan, minus the acquisition cost.

For example, if you earned $5,000 a year per customer and their average lifetime was 12 years, with an acquisition cost of $1,000 each.

Your equation would look like this:

$5,000 x 12 – $1,000 = $59,000

Generally speaking, the simple method works best for sales that are fairly consistent.

But, if your sales tend to fluctuate from customer to customer, you will likely do better using the traditional method.

In this equation, you’ll take the average retention rate and discount rate into consideration. The discount rate accounts for any inflation that happens over the years. If you’re unsure what that may be, Propeller recommends using a 10% rate.

Keep in mind, different models are better suited to different industries, and can get as specific as this one, depending on which factors most impact your consumers:

- Custom: t(52 x s x c x p)

The determination of the final CLV is dependent on which best fits your business model and industry. Some companies use just one, while others take an average of two or more CLV calculations.

How Can a Business Boost their CLV?

EConsultancy states that the probability for a business to close a sale with an existing consumer is 60-70 %, compared to 5-20% for new prospects.

Putting your marketing and production efforts into developing and improving products for the current customer base should be the priority, as should emphasis on building solid, trustworthy relationships that make clients return time and again.

This is why developing a solid post-conversion funnel is so important.

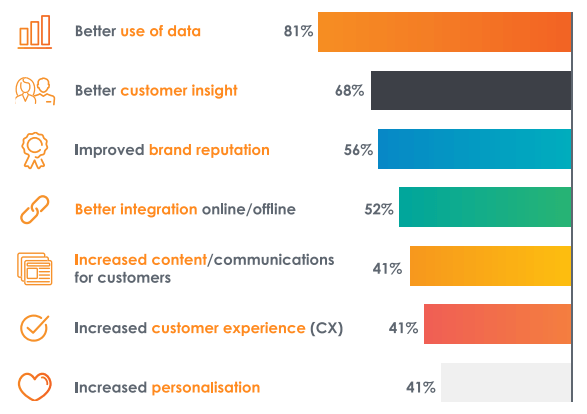

Why increasing CLV matters. Source.

There are a few measures that you can take to help your customer retention rate (and, by extension, the lifetime value of those customers). Among these are:

- Easy Returns: Making it easier for customers to return purchased products will promote their confidence in your business. The harder it is to make a return, the less likely the customer will buy from you going forward.

- Meet Expectations: If you set a delivery date for the customer, overestimate the time. Consumers put a lot of faith in a company’s ability to meet deadlines. By giving the customer a set date and getting their package to them before that date, you raise their confidence in your business’s ability to service their needs.

- Rewards Programs: Investing in a reward program that pays customers back for spending money is a great way to encourage repeat business. Not only is the consumer getting a product they would buy anyway, but they’re getting a reward on top of it.

- Free Stuff: A standard in marketing is that consumers love free stuff. By offering something free to a customer, you help to build their brand loyalty. In the future, your freebie is likely to provide them with an incentive to choose your business for their needs. Ultimately, they may consider your business in a better light because of what you offer them.

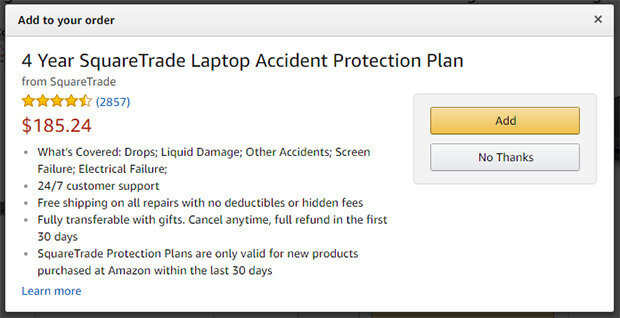

- Upselling: When a customer makes a standard purchase, having add-on items or additional options for them to buy is a good idea. This tactic can increase the long term CLV of a single customer by leveraging an extended purchase. It’s why fast-food chains like Subway offer toppings that cost extra, and you’ll often see Amazon suggest new products that complement what you’re currently buying.

Suggesting add-on’s during a purchase is a great way to increase CLV

- Keep in Touch: Increasing CLV is about building an established relationship and keeping in contact an essential part of that. However, communication is a two-way street, and you need to make it as easy for your customers to offer feedback and get in contact with the business as it is to reach out to them via email or social media.

One of the Most Overlooked Elements of CLV

Custora notes that CLV helps a business to optimize their spending for maximum value, as opposed to the minimum cost of doing business.

However, no matter the explanation, most attempt to break down customer interaction and relationships into hard numbers. They look at the metric from the perspective of leveraging customer purchases to push profit. Instead, they should be considering how the customer interacts with the business.

The biggest flaw that CLV seems to have comes from the assumption that a business’s products and services will remain stagnant over the entire course of the relationship.

As you well know, the world of business is ever-changing and evolving, and to truly appreciate the lifetime value of a consumer, you need to look at how an investment into innovation makes consumers more valuable to the business.

You’re likely to get the most mileage out of CLV when you stop considering customers as targets to extract profit from, and instead, start viewing them as partners that can help them grow value.

There are several non-monetary ways that consumers of a product can be valuable to a business, including:

- Brand Evangelism

- Collaboration

- Sharing of Data

- Trying new products and offering feedback

Each of these has its own “cost” value to your business in terms of a marketing budget. By leveraging consumers, you replace the cost to the business with the value of loyal customers.

None of these, however, show up in a CLV calculation. Customer investment doesn’t see returns in satisfied consumers. It sees returns in the form of new customers that don’t cost anything to convert, or free publicity on social media.

Considering CLV from this perspective is crucial to your long-term use of it as a metric.

Wrapping Up

All companies have buyers or subscribers, and the long-term satisfaction of these clients can lead to more business.

CLV is among the best ways to determine the value of a single customer. It helps you be aware of what you can do better, and what’s more, it offers insight into what you’re already doing well.

While it doesn’t deal directly with the hidden value of consumer marketing, it is still a sound method of cost-benefit analysis for consumers over a lifetime period. Knowing the customer lifetime value is the first step in making a business a better version of itself.