Launching a new campaign?

Then you need to be looking at your Google analytics benchmark reports.

In this article, I’ll go over what benchmark reports are and how they can help increase your sales for future campaigns.

What is Benchmark Reporting?

Benchmarking is the process of measuring the performance of a company’s products, services, and processes compared to its competitors.

Why? To see how you stack up.

Benchmarking allows companies to identify areas of opportunity by studying those who may have surpassed them previously.

With digital marketing and e-commerce campaigns specifically, it allows you to see the types of channels (organic traffic, social media, email, etc.) that should be working for you.

Which is why it’s something you want to do before you even think about launching a new campaign.

Because, aside from looking at your own numbers, looking at a benchmark report is one of the best tools we have to help determine how your time and budget should be spent.

In short, it helps you decide how to most effectively scale your efforts.

And in an industry like e-commerce, that can’t be overstated. It’s a crowded space, and each dollar in your budget needs to spent effectively.

So let’s dig into to how benchmark reporting can help you do just that.

Setting Up Benchmark Reports in Google Analytics

To be successful, benchmarking requires some serious intel.

Not only do you have to identify which competitors to benchmark against, but you need access to their internal performances or metrics.

Luckily, we live in the age of Google Analytics.

Analytics makes it easy to compare your website to similar competitors and see how much traffic each is getting – and equally important, where it’s coming from.

Using these reports, you can see if you’re doing better doing better or worse for each different traffic channel.

The cool thing is, getting this comprehensive data is as simple as clicking a button.

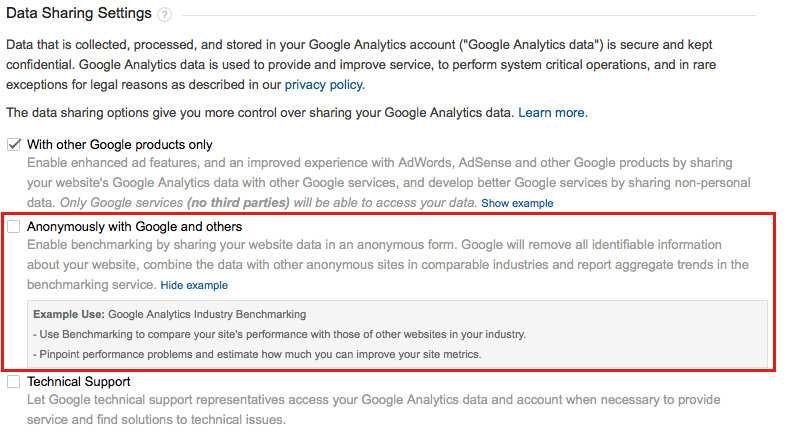

First, log in to your Google Analytics report. Once you’re in, select Accounts > Properties > Settings. Here, you’ll check the box that says “Anonymously With Google and Others.”

This allows you to set up benchmarking by anonymously sharing your website data.

Note that this means you won’t know exactly which competitors you’re being compared against, as all identifiable information is unavailable in the report.

You will, however, know how your traffic compares, and be able to pinpoint any areas that need your attention.

But let’s back up a step.

Because before you start benchmarking against competitors, you need to get a solid handle on your own numbers.

First, Review Your Numbers From Last Year

In the case of ecommerce, your goal is always to increase sales.

But to increase them, you have to know where you stand. Whether you’re launching a holiday campaign, semi-annual sale, or pushing a new product, you need to start by looking at the numbers from your last related campaign.

To do that we’re going back to good ol’ Google Analytics.

This time, you want to look at your Source/Medium report.

In Google Analytics, a source is the origin of your traffic. So if you see Google/cpc, Google is the source.

A medium is the general category of the source. So in the Google/cpc example, cpc (cost-per-click) would be the medium.

Together, this data shows you how users are finding your website, whether it be through paid search on Google or Bing, social networks, email marketing, etc.

To access the report, go to your Acquisition > All Traffic report, and sort into Source/Medium view (this is the default view). Sort them by the dates that you last ran a similar campaign.

If you’re running a recurring holiday campaign, you would select the dates from the previous year.

Once you pull the report, take note of the traffic, conversion rate, transactions and revenue from each channel.

This will give you a baseline of data to show which sources drove the most traffic and conversions last year, and an idea of how to scale your efforts this year.

By comparing each source side by side, you’ll be able to calculate which yielded the highest ROI, and adjust your strategy and budget as needed.

For example, if your PPC campaign on Bing didn’t see many click-throughs or conversions, you can reallocate some of its a budget into a channel that proved more successful.

Next, Run a Benchmark Report to Compare Against Industry Benchmarks

After you’ve evaluated your own numbers, it’s time to get back to benchmarking.

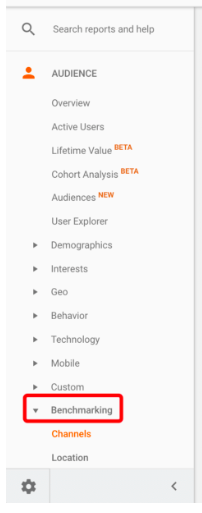

You’ll find the report under your Audience tab in Google Analytics. Again, you’ll want to select the date range of the last similar campaign.

You have three options for further filtering your benchmark report:

- Industry vertical

- Country/region

- Size by daily session

To find the right comparison, sort the filters to your best fit. So if your e-commerce company sells clothing, you would select the “clothing accessories” verticle and your primary country or region of business.

The size by daily session filter indicates how many visits a site gets per day. So if you choose the 500-999 range, you’ll be comparing your site against those in that traffic range.

When choosing, it’s important to remember to measure your site against those that receive a similar amount of traffic.

So, let’s say we run a report for clothing accessories in the United States with a session size of 500-999.

Your report will look something like this:

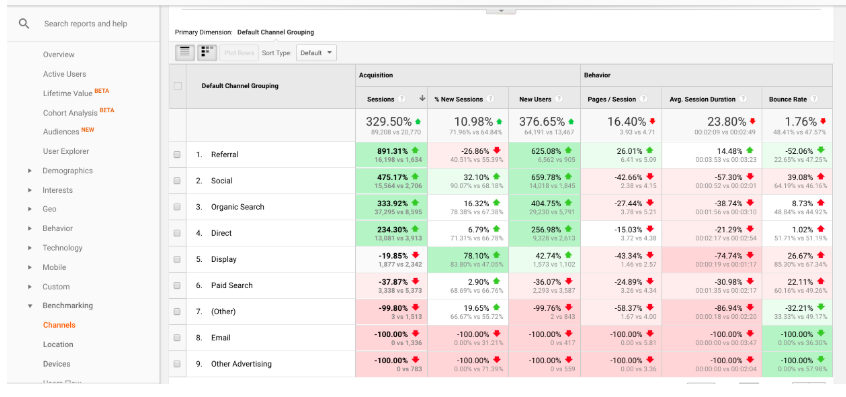

It’s showing you how your website – and more specifically, your traffic channels – performs against industry standards.

The percentages represent how much your site is trending above or below industry averages. The ones above average are displayed in green, while the traffic channels below industry average are displayed in red.

Now, in a perfect world, you’d be seeing a whole lotta green.

Realistically, you can expect to be in the red in a few areas.

And that’s okay. It just means you have some work to do this year.

How to Use Your Benchmark Reports to Increase Sales

Here’s the beauty of the benchmark report: while the red might sting a bit, it ultimately helps you identify weaknesses in your strategy.

Take a look at this report.

If I were running a new campaign, I would know that channels like email, display and paid search were seriously underperforming last year.

That doesn’t necessarily mean I need to funnel their budgets into my more successful channels like social and SEO efforts.

It means I need to investigate what went wrong. On average, competitors are doing at most 99% better than I am at paid search.

There’s some serious paid search traffic to be had out there. The problem? Almost all of it went to my competitors.

Again, that’s okay. Because all that lost traffic last year represents a new opportunity this year.

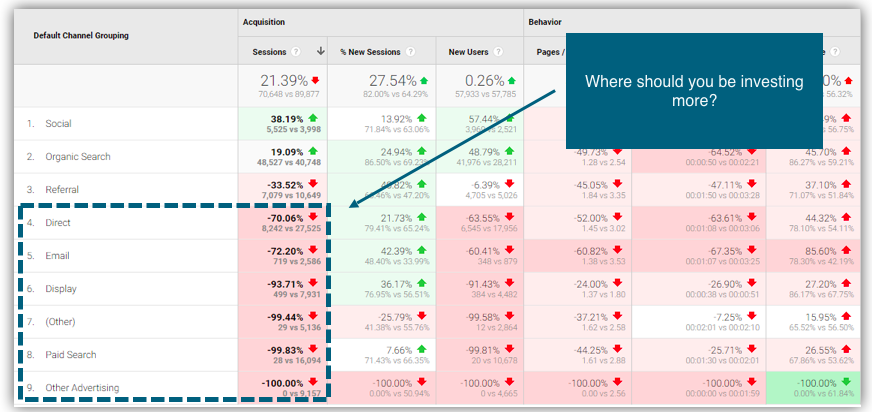

So take another look.

Maybe the budget was too small or keyword selection didn’t align with what my customers were actually searching for.

Maybe my ad copy or creative missed the mark.

Whatever it was, I know that by improving my efforts I have a good chance of gaining some that traffic I lost out on last year.

And more traffic? Means more sales.

Keep in mind, you want to use this benchmark report in conjunction with what you found when you ran your Source/Medium Google report.

It could be the case that your strategy prioritizes certain channels above others, which is reflected in your benchmark report.

For example, if Facebook ads have historically performed better for you than Google Search Ads, you would budget higher for them and expect to see a lower benchmark for Search in your report.

In that case, monitoring your benchmark report will help ensure that you’re maintaining your strengths and competitive advantage in those channels you chose to prioritize.

But if you see that multiple major channels are trending considerably below average, it may be time to rethink your strategy.

If you’re trending 90% below the industry average in both Search and Display campaigns, that could be a serious indicator that it’s time to start pumping a few more dollars into Google AdWords.

On the other hand, you may find that your competitive advantage in a field you thought you excelled in, say, email marketing, is only a negligible 7-10%.

Again, you know it works, but to really be effective you may need ramp up your efforts.

And keep in mind, the work doesn’t stop when the new campaign is launched.

Remember to consistently monitor both your Source/Medium and Benchmark reports to make sure you’re seeing improvements where you intend to and are staying on par with industry standards.

Wrapping Up Benchmark Reports

Keeping tabs on benchmark reports is a best practice across all industries, and especially in one as competitive as e-commerce.

Remember, you want to collect all the available information before you begin launch plans for a new campaign. That way, you can better scale and strategize based on real numbers and industry averages.